Here are September events that could be catalysts for 6 of our stocks CNBC

Inflation well above target, consumer sentiment at all-time low

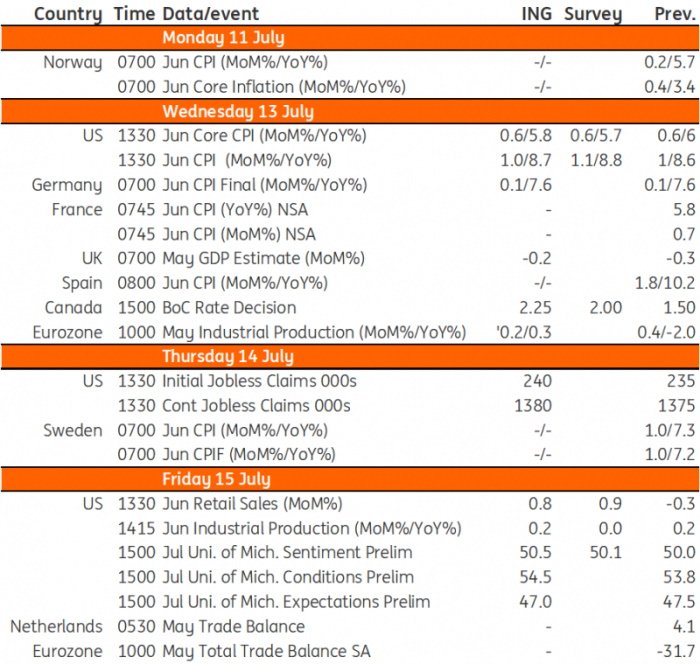

The market is favouring a 75bp rate hike from the Federal Reserve on 27 July and we agree given the tight jobs market and inflation running at more than four times the 2% targeted rate. In fact, inflation is likely to move even further above target this coming week as gasoline, food, shelter and airline fares continue to rise apace. Core inflation may slow marginally to 5.8% from 6%, but this too is well above target.

We will also be looking out for the University of Michigan consumer confidence index. It recently fell to an all-time low as the rising cost of living and plunging stock markets weighed on sentiment. This obviously is not encouraging for consumer spending growth, and we will also be closely following the inflation expectations series. It spiked last month (subsequently revised lower) and this was seen by many as the trigger for the Fed to signal it was going to hike by 75bp in June rather than the 50bp it had laid the groundwork for. Another strong reading for inflation expectations should all but confirm a second consecutive 75bp move later this month.

Canada’s housing market provides strong resilience against spikes in price

We expect the Bank of Canada to implement a 75bp move at its July 13 meeting. The economy is growing strongly, is at record employment levels and its inflation rate is running at 7.7%, the fastest rate since January 1983. The housing market is also red hot while Canada’s strong commodity-producing sectors mean it is far more resilient than most major economies to the spike in prices.

Weakening demand and negative trade balance

Eurozone industry continues to struggle with supply chain problems, while signs of weakening demand have also become more apparent. Both are bad news for a recovery in production although we do see some improvements in supply chains that may help production to catch up in the months ahead. Backlogs of work are still sizable, so don’t expect a sudden drop in May production figures due to weaker demand just yet. Nevertheless, the outlook for industry remains soft at the moment. Also, look out for the trade balance, which is set to be negative again on the back of high energy prices and a difficult export environment.

Developed Markets Economic Calendar

Source: ING

Source: ING

Markets snapped their three-week winning run last week, marred by increased volatility, after the RBI hiked repo rate by 50 basis points and raised inflation target for FY23.

The sentiment weakened further as global markets tumbled ahead of the US Federal Reserve’s monetary policy meeting this week.

Meanwhile, last week the BSE Sensex touched a high of 55,832 early in the week, and thereafter drifted to a low of 54,206, and finally ended the week with a loss of 1,466 points or 2.6 per cent.

The NSE Nifty shed 2.3 per cent to 16,202, and the Bank Nifty dropped 2.2 per cent.

This week, all eyes will be on the US Fed’s two-day monetary policy meeting on June 14 and 15, where investors will track Fed chair Jerome Powell’s outlook on energy prices, inflation and economic recovery.

According to a Reuters poll, the US Fed is expected to hike interest rate by 50 basis points in June and July, with higher probability of a similar rate hike in September.

That apart, Bank of England and Bank of Japan are also slated to take interest rate decisions on Thursday and Friday, respectively.

Back home, markets will take note of crucial inflation numbers.

The Consumer Price Index-based inflation for May will be announced on Monday, followed by Wholesale Price Index-based inflation on Tuesday.

Technically, weekly trend for the Nifty has turned bearish with its 20-Weekly Moving Average slipping below the -.

The broader trend indicates that the index could slide towards 15,800 – 15,300 if the 50-pack index fails to cross 16,900 level.

Against this backdrop, the NSE Nifty may test its support at 16,000-mark, below which the next significant support is at 15,800.

Similarly, the BSE Sensex may swing in a range of 53,300 to 55,300, with support expected around 53,950 and resistance at 55,050.

Among individual stocks, Bajaj Auto will be in focus ahead of its board meet on June 14 to consider share buyback.

Besides, recently listed LIC India and Prudent Advisory will be on investor radar as the compulsory 30-day lock-in period for anchor investors will end on June 13 and June 17, respectively.

Dear Reader,

Dear Reader,Business Standard has always strived hard to provide up-to-date information and commentary on developments that are of interest to you and have wider political and economic implications for the country and the world. Your encouragement and constant feedback on how to improve our offering have only made our resolve and commitment to these ideals stronger. Even during these difficult times arising out of Covid-19, we continue to remain committed to keeping you informed and updated with credible news, authoritative views and incisive commentary on topical issues of relevance.

We, however, have a request.

As we battle the economic impact of the pandemic, we need your support even more, so that we can continue to offer you more quality content. Our subscription model has seen an encouraging response from many of you, who have subscribed to our online content. More subscription to our online content can only help us achieve the goals of offering you even better and more relevant content. We believe in free, fair and credible journalism. Your support through more subscriptions can help us practise the journalism to which we are committed.

Support quality journalism and subscribe to Business Standard.

Digital Editor

The wait is over and you can now shop for award-winning products by Alberta makers at the upcoming Made in Alberta Markets, May 18 and 19, 9 a.m. to 3 p.m., at Bow Valley Square, 205 5 Ave. S.W.

Discover Alberta-made products including skin care by 2021 Beauty Award winner The Potion Masters, exquisitely crafted tableware and drinkware from 2021 Craft Award winner Quinspired Ceramics, libations from 2020 Alcoholic Drink Award winner The Fort Distillery, laser-cut, heirloom-quality puzzles from 2021 Games & Leisure Award winner StumpCraft Puzzles, and more.

Entry to the markets is free and open to the public.

For more information about the Made in Alberta Awards program and to read stories about amazing Alberta makers, visit MadeInAlbertaAwards.com. And stay tuned for more information about our upcoming Made in Alberta Conference this fall.

The Made in Alberta Awards are generously sponsored by Oxford Properties, MNP, Shedpoint and Calgary Economic Development’s Trade Accelerator Program