The Saskatchewan government is raising the cost for people who want to attend big events or experience entertainment in the province.

A sweeping expansion of the provincial sales tax base was announced Wednesday with the release of the 2022-23 budget.

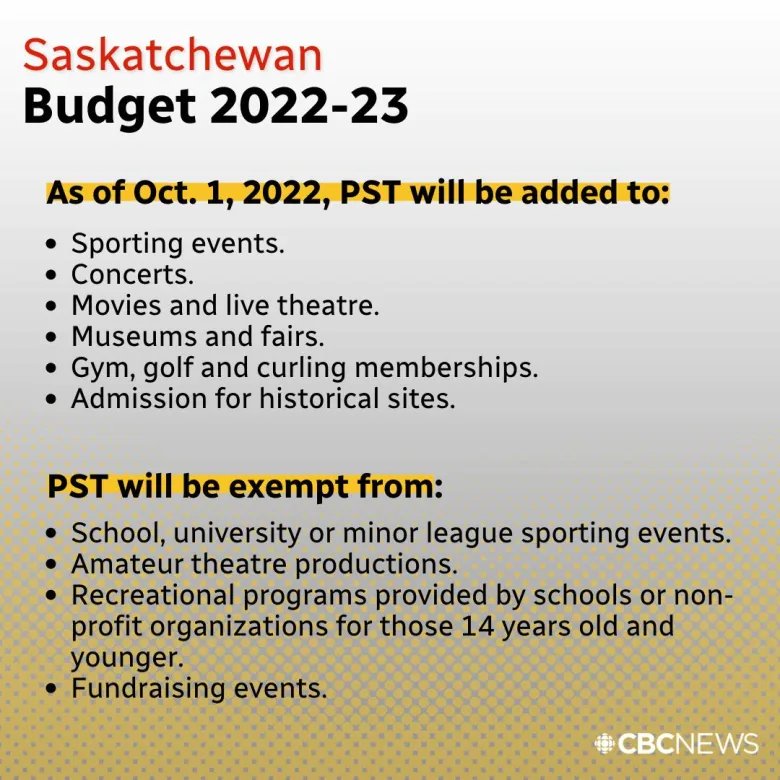

The changes come into effect in October 2022 and will see people paying an extra six per cent on ticket prices for big sporting events, concerts and professional theatre.

The tax is also being added to movie theatres, museums, zoos and historical sites, as well as tickets for fairs, rodeos, trade shows and arts and crafts shows. Furthermore, it will be extended to people buying memberships to the gyms, golf courses and curling clubs.

It will also be tacked on to hunting and fishing guide fees and outfitter services.

Finance Minister Donna Harpauer said the expansion will generate about $21 million annually. She said it targets events and services already taxed under the federal goods and services tax (GST).

The government did not consult with venues regarding these changes. Harpauer told reporters the expansion would not affect small groups hit hard by the pandemic.

“It doesn’t apply to your small town rodeos or events,” Harpauer said.” This is going to be bigger concert events, your Roughrider tickets. It’s your larger events.”

Opposition finance critic Trent Wotherspoon disagreed and said this tax expansion was another blow to Saskatchewan people and industries struggling because of the pandemic.

He called the government out of touch with working families, saying it didn’t make any sense for the government to add a tax onto “Rider games and concerts and rodeos and Agribition — on the things that will allow us to come together after the time we’ve had to be apart.”

The government said exemptions apply to tickets for school, university or minor league sports, amateur theatre productions that do not pay the artists and events put on by a public sector body.

Exemptions also extend to fees for youth programming, like hockey, dance and music, if the activities are run by a school or a non-profit.

Fundraisers where part of the cost of admission can reasonably be considered a donation to a charity are also exempt.

More budget-related stories: