Reports & Events Monthly Calendar – September 2022 The National Academies of Sciences, Engineering, and Medicine

Tag: Reports

Great-West Lifeco reports second quarter 2022 results

This release should be read in conjunction with Great-West Lifeco’s Quarterly Report to Shareholders for the period ended June 30, 2022, available on greatwestlifeco.com. The Quarterly Report to Shareholders includes the Company’s interim Management’s Discussion & Analysis (MD&A) and condensed consolidated interim unaudited Financial Statements for the period, prepared in accordance with International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board unless otherwise noted. Additional information relating to Great-West Lifeco is available on sedar.comOpens a new website in a new window. Readers are referred to the cautionary notes regarding Forward-Looking Information and Non-GAAP Financial Measures and Ratios at the end of this release. All figures are expressed in millions of Canadian dollars, unless otherwise noted.

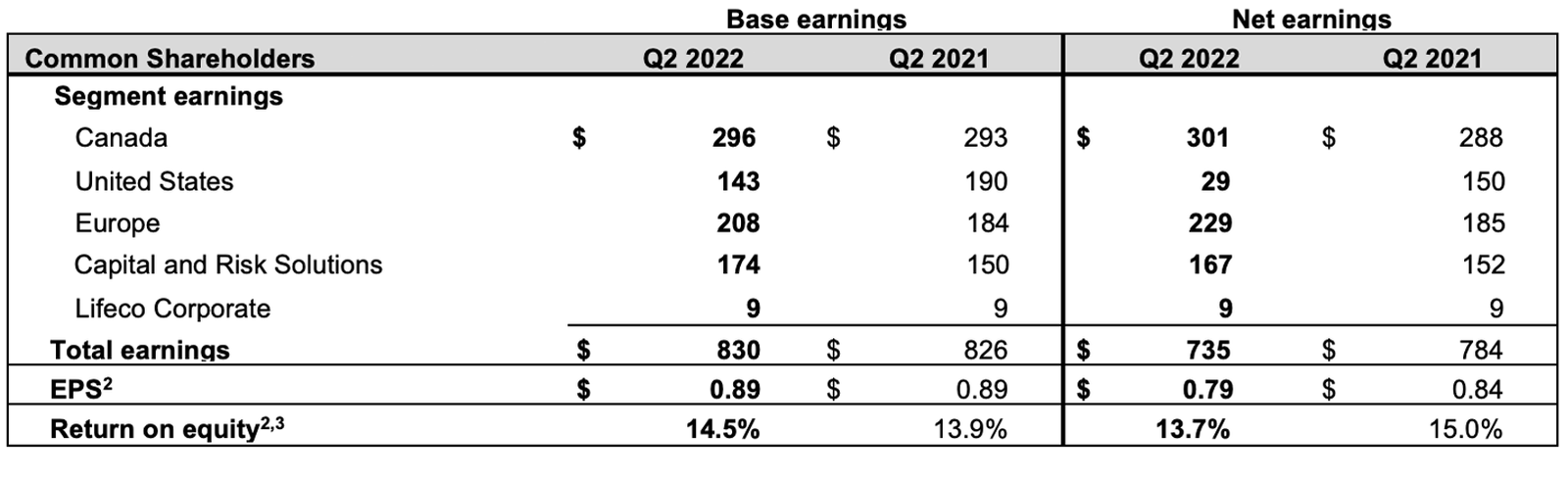

Winnipeg, August 3, 2022 – Great-West Lifeco Inc. (Lifeco or the Company) today announced its second quarter 2022 results. Net earnings of $735 million were down by 6% and base earnings1 of $830 million were slightly up compared to the same period in 2021.

“Against the backdrop of falling equity markets and elevated inflation, the Company’s well diversified and resilient business portfolio delivered solid results,” said Paul Mahon, President and CEO of Great-West Lifeco. “Strong insurance and investment results offset the dampening effect of equity markets on wealth and asset management businesses. We are pleased with the progress we are making on our strategic priorities including the recent close of Empower’s acquisition of the full-service retirement business of Prudential Financial Inc. The integration of this and our other acquired businesses in the U.S. are on track and we remain confident in the outlook for Empower and our value creation objectives for the business.”

Key Financial Highlights

In the second quarter of 2022, equity markets in the regions where the Company operates exhibited heightened volatility and ended 5% to 16% lower than March 31, 2022 levels. Interest rates increased 80-105bps in response to elevated, broad based levels of inflation which are impacting business and consumer confidence. In addition, the Canadian dollar strengthened notably against the British pound and the Euro, although weakened somewhat against the U.S. dollar.

Base earnings per share (EPS) for the second quarter of 2022 of $0.89 was consistent with $0.89 a year ago. This reflected strong insurance and investment results in all geographies which more than offset reduced net fee income from wealth management businesses and negative currency movement impacts. Base earnings grew year-over-year in the Canada, Europe and Capital and Risk Solutions segments. The U.S. segment base earnings were the most impacted by market conditions resulting in lower year-over-year base earnings notwithstanding the addition of Prudential business related base earnings of $45 million (US$35 million).

1 Base earnings is a non-GAAP financial measure. Refer to the “Non-GAAP Financial Measures and Ratios” section of this document for additional details.2 Base EPS and base return on equity are non-GAAP ratios. Refer to the “Non-GAAP Financial Measures and Ratios” section of this document for additional details.3 Base return on equity and return on equity are calculated using the trailing four quarters of applicable earnings and common shareholders’ equity.

Reported net EPS for the second quarter of 2022 was $0.79, down from $0.84 a year ago, primarily due to higher acquisition related costs largely from the Prudential acquisition. Also, the second quarter of 2021 included a revaluation of deferred taxes resulting in an increase in taxes in the Europe segment; there was no revaluation in 2022.

Return on equity of 13.7% and base return on equity of 14.5% in the second quarter of 2022 continued to be solid in light of the macroeconomic challenges and remain within our target range.

Business Highlights

Strategic acquisition of the full-service retirement business of Prudential Financial, Inc. closed

- On April 1, 2022, a Lifeco subsidiary, Great-West Life & Annuity Insurance Company (GWL&A), which operates primarily as “Empower”, closed the previously announced acquisition of the full-service retirement business of Prudential Financial, Inc. (Prudential). With the close of the acquisition, Empower’s reach in the U.S. has expanded to more than 17.4 million retirement plan participants and assets under administration (AUA) to US$1.3 trillion on behalf of approximately 71,000 workplace savings plans as of June 30, 2022.

The Company funded the total transaction value of US$3,480 million with US$1,193 million of limited recourse capital notes and US$823 million of short-term debt, in addition to existing resources.

The Prudential acquisition added $116 billion in total on balance sheet assets, $1 billion in other assets under management4 and $250 billion in other assets under administration4 to the U.S. segment as at June 30, 2022.

On August 1, 2022, Great-West Life & Annuity Insurance Company changed its legal name to Empower Annuity Insurance Company of America.

Capital strength and financial flexibility maintained

- The Company’s capital position remained strong at June 30, 2022, with a LICAT Ratio5 for Canada Life, Lifeco’s major Canadian operating subsidiary, of 117% which is near the high end of the Company’s internal target range and above the supervisory target. The LICAT Ratio reduced by two points in the quarter mainly due to the material in-quarter increase in interest rates.

- On July 21, 2022, OSFI released the 2023 LICAT Guideline. The Company will first report under this guideline in its March 31, 2023 LICAT filing. Based on an initial review of the guideline under the current market and economic conditions, the Company expects a positive impact to the March 31, 2023 LICAT Ratio6 on transition.

Consolidated assets of $670 billion and assets under administration7 of $2.3 trillion

- Consolidated assets were approximately $670 billion and AUA were approximately $2.3 trillion as at June 30, 2022, an increase of 6% and 2%, respectively, from December 31, 2021.

Other Developments

- On June 28, 2022, the Company hosted an analyst discussion on the expected impacts of the upcoming implementation of IFRS 178. The Company does not expect the new standard to have a material financial impact or to change the Company’s underlying business strategy9.

- The Company participated in the International Sustainability Standards Board (ISSB) consultation on two new draft standards which will help facilitate consistent, comparable and timely sustainability information for the good of the capital markets and, more importantly, our planet and our communities. The Company is a proud supporter of the ISSB as a member of the Coalition of Canadian Champions.

4 Refer to the “Glossary” section of the Company’s second quarter of 2022 interim MD&A for additional details on the composition of other assets under management and other assets under administration.

5 The Life Insurance Capital Adequacy Test (LICAT) Ratio is based on the consolidated results of The Canada Life Assurance Company (Canada Life), Lifeco’s major Canadian operating subsidiary. The LICAT Ratio is calculated in accordance with the Office of Superintendent of Financial Institutions (OSFI)’ guideline – Life Insurance Capital Adequacy Test. Refer to the “Capital Management and Adequacy” section of the Company’s second quarter of 2022 interim MD&A for additional details.

6 Actual impact will depend on market and economic conditions and the Company’s operating results at the time of transition.

7 Assets under administration is a non-GAAP financial measure. Refer to the “Non-GAAP Financial Measures and Ratios” section of this document for additional details.

8 IFRS 17, Insurance Contracts (IFRS 17) will replace IFRS 4, Insurance Contracts effective January 1, 2023. The new standard will change the recognition and measurement of insurance contracts and the corresponding presentation and disclosures in the Company’s financial statements.

9 Refer to the “Update on transition to IFRS 17 and IFRS 9” section of the Company’s second quarter of 2022 interim MD&A for additional details.

SEGMENTED OPERATING RESULTS

For reporting purposes, Lifeco’s consolidated operating results are grouped into five reportable segments – Canada, United States, Europe, Capital and Risk Solutions and Lifeco Corporate – reflecting the management and corporate structure of the Company. For more information, refer to the Company’s second quarter of 2022 interim MD&A.

CANADA

- Q2 Canada segment base earnings of $296 million and net earnings of $301 million – Base earnings for the second quarter of 2022 were $296 million, up 1% compared to the second quarter of 2021. The increase was primarily due to favourable morbidity and investment experience in Group Customer, partially offset by lower fee income and unfavourable experience in Individual Customer.

- Canada Life announced 2022 dividend scale for participating life insurance – On May 12, 2022, Canada Life announced the dividend scale interest rate will increase for the policies in the combined open participating account effective July 1, 2022 to 5.25%.

- Significant joint sale with ClaimSecure Inc. (ClaimSecure) – Canada Life Group Customer and ClaimSecure had their first significant joint sale in the second quarter of 2022. Integration is going well and quoting momentum is strong. Partnering with ClaimSecure has enhanced Canada Life’s ability to provide leading workplace benefits solutions to Canadians.

UNITED STATES

- Q2 United States (U.S.) Financial Services base earnings of US$123 million ($156 million) and net earnings of US$84 million ($107 million) – U.S. Financial Services base earnings for the second quarter of 2022 were US$123 million ($156 million), down US$16 million or 12% from the second quarter of 2021. The decrease was primarily due to lower Empower net fee income and higher operating expenses to support participant growth. These items were partially offset by base earnings of US$35 million ($45 million) related to the Prudential acquisition as well as higher contributions from investment experience.

Transaction costs of US$42 million ($53 million) related to the Prudential acquisition were included in the U.S. Corporate results.

- Run-rate cost synergies are on track – Annualized run rate cost synergies of US$88 million pre-tax have been achieved as of June 30, 2022 related to the Company’s acquisition of MassMutual’s retirement services business compared to US$80 million as of March 31, 2022. The Company remains on track to achieve run rate cost synergies of US$160 million pre-tax at the end of integration in 2022.

Empower anticipates realizing cost synergies through the migration of Prudential’s retirement services business onto Empower’s recordkeeping platform. Estimated run-rate cost synergies of US$180 million are expected to be phased in over 24 months primarily when systems migrations are completed. As of June 30, 2022, annualized run rate cost synergies of US$25 million pre-tax have been achieved.

- Empower growth in AUA and participant accounts – Empower AUA increased to US$1.3 trillion at June 30, 2022 from US$1.1 trillion at December 31, 2021. Empower participant accounts have grown to 17.4 million at June 30, 2022, up from 13.0 million at December 31, 2021. The increases in AUA and participants were primarily the result of the Prudential acquisition.

- Q2 Putnam net loss of US$9 million ($12 million) – Putnam’s net loss for the second quarter of 2022 was US$9 million ($12 million), compared to net earnings of US$17 million ($21 million) in the second quarter of 2021, primarily due to lower asset based fee revenue and lower net investment income, partially offset by lower expenses. For Putnam, there were no differences between net and base earnings (loss).

- Putnam continues to sustain strong investment performance – As of June 30, 2022, approximately 65% and 79% of Putnam’s fund assets performed at levels above the Lipper median on a three-year and five-year basis, respectively. In addition, 42% and 64% of Putnam’s fund assets were in the Lipper top quartile on a three-year and five-year basis, respectively. Putnam has 23 funds currently rated 4 or 5 stars by Morningstar Ratings.

- Putnam launched new sustainable investment options – During the second quarter of 2022, Putnam made a series of product-related announcements to meet evolving market demand for sustainable investment options, which are expected to launch over the coming months.

EUROPE

- Q2 Europe segment base earnings of $208 million and net earnings of $229 million – Base earnings for the second quarter of 2022 were $208 million, up 13% compared to the second quarter of 2021, primarily due to favourable investment experience in the U.K, favourable morbidity experience in Ireland as well as favourable mortality experience in the U.K. and Ireland, partially offset by the impact of currency movement. In addition, the Company had a revaluation of deferred taxes resulting in an increase in taxes in the second quarter of 2021; there was no revaluation in 2022. Net earnings for the second quarter of 2022 were $229 million, up $44 million or 24% from the second quarter of 2021, primarily due to an increase in base earnings as well as favourable market-related impacts driven by property cash flows in the U.K. in 2022 and unfavourable U.K. tax legislation changes in 2021. The increase was partially offset by lower actuarial assumption changes.

- Strong Insurance and Annuity sales10 – In the second quarter of 2022, Insurance and Annuity sales increased by 21% over the second quarter of 2021.

- Irish Life invested in a minority shareholding in Multiply.AI (Multiply) – In the second quarter of 2022, Irish Life invested in a minority shareholding in U.K.-based financial technology company Multiply. Multiply helps clients achieve their financial goals by connecting them through an automated digital advice service to their own individual financial plans with recommended next steps and access to their chosen advisor. This investment allows Irish Life to build on its existing digital capabilities by designing and building compliant digital customer journeys specific to the Irish market.

- Canada Life U.K. recognized as leading provider – The recent group protection industry survey ‘Group Watch 2022’ from Swiss Re confirmed Canada Life U.K. as the leading provider by in-force premium, policies and lives insured.

- Canada Life’s Credit Rating improved in Germany – In the second quarter of 2022, ASSEKURATA Assekuranz Rating-Agentur GmbH, a German financial strength rating agency, raised the credit rating of Canada Life Assurance Europe plc, a subsidiary of Canada Life, from AA- to AA, making Canada Life one of the highest rated life insurance companies in Germany.

10 Refer to the “Glossary” section of the Company’s second quarter of 2022 interim MD&A for additional details on the composition of sales.

CAPITAL AND RISK SOLUTIONS

- Q2 Capital and Risk Solutions segment base earnings of $174 million and net earnings of $167 million Base earnings for the second quarter of 2022 were $174 million, up 16% compared to the second quarter of 2021, primarily due to growth in business in-force, favourable claims experience in the U.S. life business and the commutation of a reinsurance treaty, partially offset by the impact of currency movement.

- Continue growing presence in the global reinsurance market – In the second quarter of 2022, Capital and Risk Solutions continued growing its international presence in Asia, Europe and the U.S. The Company entered into another reinsurance transaction in Israel, completed new longevity contracts in the U.K. and added new structured transactions in the U.S. during the quarter.

QUARTERLY DIVIDENDS

The Board of Directors approved a quarterly dividend of $0.4900 per share on the common shares of Lifeco payable September 29, 2022 to shareholders of record at the close of business September 1, 2022.

In addition, the Directors approved quarterly dividends on Lifeco’s first preferred shares payable September 29, 2022 to shareholders of record at the close of business September 1, 2022, as follows:

|

First Preferred Shares |

Amount, per share |

|

Series G |

$0.3250 |

|

Series H |

$0.30313 |

|

Series I |

$0.28125 |

|

Series L |

$0.353125 |

|

Series M |

$0.3625 |

|

Series N |

$0.109313 |

|

Series P |

$0.3375 |

|

Series Q |

$0.321875 |

|

Series R |

$0.3000 |

|

Series S |

$0.328125 |

|

Series T |

$0.321875 |

|

Series Y |

$0.28125 |

For purposes of the Income Tax Act (Canada), and any similar provincial legislation, the dividends referred to above are eligible dividends.

Second Quarter Conference Call

Lifeco’s second quarter conference call and audio webcast will be held August 4, 2022 at 2:30 p.m. (ET). The call and webcast can be accessed through greatwestlifeco.com/news-events/events or by phone at:

- Participants in the Toronto area: 416-915-3239

- Participants from North America: 1-800-319-4610

A replay of the call will be available until September 4, 2022 and can be accessed by calling 1-855-669- 9658 or 604-674-8052 (passcode: 9170). The archived webcast will be available on greatwestlifeco.com.

Selected financial information is attached.

GREAT-WEST LIFECO INC.

Great-West Lifeco is an international financial services holding company with interests in life insurance, health insurance, retirement and investment services, asset management and reinsurance businesses. We operate in Canada, the United States and Europe under the brands Canada Life, Empower, Putnam Investments, and Irish Life. At the end of 2021, our companies had approximately 28,000 employees, 215,000 advisor relationships, and thousands of distribution partners – all serving over 33 million customer relationships across these regions. Great-West Lifeco trades on the Toronto Stock Exchange (TSX) under the ticker symbol GWO and is a member of the Power Corporation group of companies. To learn more, visit greatwestlifeco.com.

Basis of presentation

The condensed consolidated interim unaudited financial statements of Lifeco have been prepared in accordance with International Financial Reporting Standards (IFRS) unless otherwise noted and are the basis for the figures presented in this release, unless otherwise noted.

Cautionary note regarding Forward-Looking Information

This release may contain forward-looking information. Forward-looking information includes statements that are predictive in nature, depend upon or refer to future events or conditions, or include words such as “will”, “may”, “expects”, “anticipates”, “intends”, “plans”, “believes”, “estimates”, “objective”, “target”, “potential” and other similar expressions or negative versions thereof. These statements include, without limitation, statements about the expected impact (or lack of impact) of IFRS 17, Insurance Contracts and IFRS 9, Financial Instruments on the Company’s business strategy, financial strength, deployable capital, Life Insurance Capital Adequacy Test (LICAT) ratio, base and net earnings, shareholders’ equity, ratings and leverage ratios. Forward-looking information also includes statements about the Company’s operations, business (including business mix), financial condition, expected financial performance (including revenues, earnings or growth rates), ongoing business strategies or prospects, climate-related goals, anticipated global economic conditions and possible future actions by the Company, including statements made with respect to the expected cost (including deferred consideration), benefits, timing of integration activities and timing and extent of revenue and expense synergies of acquisitions and divestitures, including but not limited to the acquisitions of the full-service retirement business of Prudential Financial Inc. (Prudential), Personal Capital Corporation (Personal Capital) and the retirement services business of Massachusetts Mutual Life Insurance Company (MassMutual), expected capital management activities and use of capital, estimates of risk sensitivities affecting capital adequacy ratios, expected dividend levels, expected cost reductions and savings, expected expenditures or investments (including but not limited to investment in technology infrastructure and digital capabilities and solutions), the timing and completion of the joint venture between Allied Irish Banks plc and Canada Life Irish Holding Company Limited, the impact of regulatory developments on the Company’s business strategy and growth objectives, the expected impact of the current pandemic health event resulting from the coronavirus (COVID-19) and related economic and market impacts on the Company’s business operations, financial results and financial condition.

Forward-looking statements are based on expectations, forecasts, estimates, predictions, projections and conclusions about future events that were current at the time of the statements and are inherently subject to, among other things, risks, uncertainties and assumptions about the Company, economic factors and the financial services industry generally, including the insurance, mutual fund and retirement solutions industries. They are not guarantees of future performance, and the reader is cautioned that actual events and results could differ materially from those expressed or implied by forward-looking statements. Many of these assumptions are based on factors and events that are not within the control of the Company and there is no assurance that they will prove to be correct. In particular, statements about the expected impact of IFRS 17 on the Company (including statements about the impact on base and net earnings and the Canada Life Assurance Company LICAT Ratio) are based on the Company’s expected 2022 IFRS 4 earnings mix and composition as at the start of 2022, adjusted to reflect fully synergized earnings from the acquisitions of MassMutual’s and Prudential’s retirement businesses, and on current market and economic conditions. In all cases, whether or not actual results differ from forward-looking information may depend on numerous factors, developments and assumptions, including, without limitation, the severity, magnitude and impact of the COVID-19 pandemic including the effects of the COVID-19 pandemic and the effects of governments’ and other businesses’ responses to the COVID-19 pandemic on the economy and the Company’s financial results, financial condition and operations), the duration of COVID-19 impacts and the availability and adoption of vaccines, the effectiveness of vaccines, the emergence of COVID-19 variants, geopolitical tensions and related economic impacts, assumptions around sales, fee rates, asset breakdowns, lapses, plan contributions, redemptions and market returns, the ability to integrate the acquisitions of Personal Capital and the retirement services business of MassMutual and Prudential, the ability to leverage Empower’s, Personal Capital’s and MassMutual’s and Prudential’s retirement services businesses and achieve anticipated synergies, customer behaviour (including customer response to new products), the Company’s reputation, market prices for products provided, sales levels, premium income, fee income, expense levels, mortality experience, morbidity experience, policy and plan lapse rates, participant net contribution, reinsurance arrangements, liquidity requirements, capital requirements, credit ratings, taxes, inflation, interest and foreign exchange rates, investment values, hedging activities, global equity and capital markets (including continued access to equity and debt markets), industry sector and individual debt issuers’ financial conditions (including developments and volatility arising from the COVID-19 pandemic, particularly in certain industries that may comprise part of the Company’s investment portfolio), business competition, impairments of goodwill and other intangible assets, the Company’s ability to execute strategic plans and changes to strategic plans, technological changes, breaches or failure of information systems and security (including cyber attacks), payments required under investment products, changes in local and international laws and regulations, changes in accounting policies and the effect of applying future accounting policy changes, changes in actuarial standards, unexpected judicial or regulatory proceedings, catastrophic events, continuity and availability of personnel and third party service providers, the Company’s ability to complete strategic transactions and integrate acquisitions, unplanned material changes to the Company’s facilities, customer and employee relations or credit arrangements, levels of administrative and operational efficiencies, changes in trade organizations, and other general economic, political and market factors in North America and internationally. In addition, as we work to advance our climate goals, external factors outside of Lifeco’s reasonable control may act as constraints on their achievement, including varying decarbonization efforts across economies, the need for thoughtful climate policies around the world, more and better data, reasonably supported methodologies, technological advancements, the evolution of consumer behavior, the challenges of balancing interim emissions goals with an orderly and just transition, and other significant considerations such as legal and regulatory obligations.

The reader is cautioned that the foregoing list of assumptions and factors is not exhaustive, and there may be other factors listed in other filings with securities regulators, including factors set out in the Company’s 2021 Annual MD&A under “Risk Management and Control Practices” and “Summary of Critical Accounting Estimates” and in the Company’s annual information form dated February 9, 2022 under “Risk Factors”, which, along with other filings, is available for review at www.sedar.comOpens a new website in a new window. The reader is also cautioned to consider these and other factors, uncertainties and potential events carefully and not to place undue reliance on forward-looking information.

Other than as specifically required by applicable law, the Company does not intend to update any forward-looking information whether as a result of new information, future events or otherwise.

Cautionary note regarding Non-GAAP Financial Measures and Ratios

This release contains some non-Generally Accepted Accounting Principles (GAAP) financial measures and non-GAAP ratios as defined in National Instrument 52-112 “Non-GAAP and Other Financial Measures Disclosure”. Terms by which non-GAAP financial measures are identified include, but are not limited to, “base earnings (loss)”, “base earnings (loss) (US$)” and “assets under administration”. Terms by which non-GAAP ratios are identified include, but are not limited to, “base earnings per common share (EPS)”, and “base return on equity (ROE)”. Non-GAAP financial measures and ratios are used to provide management and investors with additional measures of performance to help assess results where no comparable GAAP (IFRS) measure exists. However, non-GAAP financial measures and ratios do not have standard meanings prescribed by GAAP (IFRS) and are not directly comparable to similar measures used by other companies. Refer to the “Non-GAAP Financial Measures and Ratios” section in this release for the appropriate reconciliations of these non-GAAP financial measures to measures prescribed by GAAP as well as additional details on each measure and ratio.

For more information:

Media Relations

Liz Kulyk

204-391-8515

media.relations@canadalife.com

Investor Relations

Deirdre Neary

647-328-2134

deirdre.neary@canadalife.com

Reports & Events Monthly Calendar – August 2022 | National Academies

“Reports & Events” is a monthly tip sheet for the news media that highlights selected meetings of interest and reports from the National Academies of Sciences, Engineering, and Medicine.

Selected Events in August 2022

Click on each event title below to access meeting details, an agenda, and registration information, or contact the Office of News and Public Information (e-mail news@nas.edu). Reporters should register for all meetings. Find more National Academies events at https://www.nationalacademies.org/events.

Pediatric Disaster Science

Aug. 1 and 2

Pediatric disaster science involves research that investigates the impacts of exposure to trauma, infectious diseases, and other hazards during a public health emergency or disaster on the pediatric population. This virtual symposium will gather government, academic, clinical and community stakeholders, and subject matter experts to examine perspectives and scientific needs related to disasters affecting infants, children, and adolescents.

Children’s Environmental Health

Aug. 1-4

This workshop will bring together experts in epidemiology, toxicology, dose response methodology, and exposure science to discuss the state of science for children’s environmental health. Sessions will discuss what is known about vulnerability to environmental exposures at specific stages of life and development, and opportunities to improve regulatory decision-making about environmental health, among other topics.

Air Force Needs for Modern-Day Warfare

Aug. 2

New technologies and widespread digitization are changing modern-day warfare. Discussions during this webinar will focus on how the Air Force can overcome the operational, organizational, and technical challenges that result from these changes.

Evaluating COVID-19 Related Surveillance Measures for Decision-Making

Aug. 3

A webinar will highlight new and updated COVID-19-related data measures and surveillance strategies — such as wastewater surveillance and genome sequence testing — and discuss how they can be used to inform policy decisions.

Alternative Protein Sources: Balancing Food Innovation, Sustainability, Nutrition, and Health

Aug. 17 and 18

This virtual workshop will explore the state of the science on alternative protein sources as they relate to issues around diet quality, nutrition, and sustainability. Presenters will look at the health, environmental, socioeconomic, and ethical impacts of alternative proteins in the diet, as well as the implications for industry, consumers, and regulation.

Indoor Air Management of Airborne Pathogens

Aug. 18

This workshop, the first in a new series, will explore building management to reduce the transmission of airborne pathogens. Participants will share their experiences with managing enclosed spaces during the pandemic, and identify promising practices that could be adopted to make these places safer. Speakers will highlight progress made since 2020, identify critical research gaps, and explore barriers to implementation.

Climate Conversations: Wildfire

Aug. 25

Climate change is increasing the frequency and severity of wildfires and extent of area burned in the U.S., putting more people at risk of exposure to fire and smoke. This webinar will explore how planners and decision-makers are coping with these challenges and working to protect the built environment and human health.

National Tools of the Trade Conference

Aug. 29-31

This annual event brings together a wide array of practitioners in the transportation sector to discuss methods, tools, and techniques designed to improve transportation planning for small and medium-sized communities. Transportation to and within national parks and federal lands will be a focus of this year’s conference.

Reports Scheduled for Release in August

Release dates for the following consensus reports and proceedings from the National Academies depend on successful completion of the review process and publishing schedules. Reporters who would like to be notified when a report is due for release should contact the Office of News and Public Information (e-mail news@nas.edu) and ask to be placed on a contact list.

Emerging Hazards in Commercial Aviation

The first in a series, this report provides an initial assessment of major trends and potential emerging hazards in air transportation in the United States, reviews safety culture and how air safety is monitored, and lays out a plan for further studies.

Review of Fate, Exposure, and Effects of Sunscreens in Aquatic Environments and Implications for Sunscreen Usage and Human Health

This report reviews the state of science on UV filters found in sunscreen, their effects on aquatic environments, and potential public health implications associated with changes in sunscreen usage. The report will identify information gaps and future research opportunities.

ADDITIONAL RESOURCES FOR REPORTERS

Impact of chronic hepatitis on cardiovascular events among type 2 diabetes patients in Taiwan pay-for-performance program – Scientific Reports

Research subjects

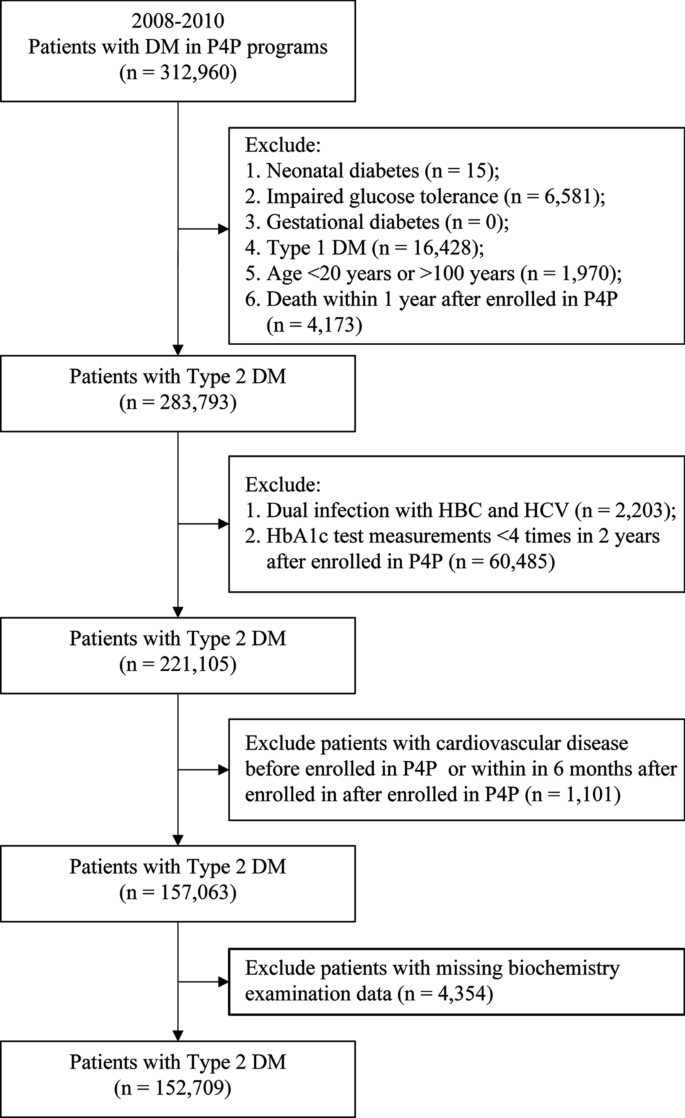

Patients with T2DM who joined the P4P from 2008 to 2010 were enrolled. Patients with a confirmed diagnosis of T2DM were defined as those who were hospitalized at least once or came in for outpatient visits at least three times within 1 year and had a primary or secondary diagnosis International Classification of Diseases (ICD) code “250,” “250.00,” or “250.02”38,39. Among them, patients with type 1 DM “250.x1” * or “250.x3;” gestational DM “648.0” or “648.8;” neonatal DM “775.1;” abnormal glucose tolerance test “790.2;” age < 20 years or > 100 years; and those who died within 1 year of joining P4P were excluded. Finally, 283,793 patients were included (Fig. 1). Based on the status of comorbid chronic hepatitis at enrollment, the patients were divided into four groups: no comorbid chronic hepatitis, named as “No chronic hepatitis”; comorbid liver B, named as “Hepatitis B” group; comorbid liver, named as “Hepatitis C” group; patients without viral hepatitis and with comorbid fatty liver were named as the “Fatty liver disease” group and were followed-up until the end of 2017. The “no comorbid chronic hepatitis” group was used as the reference group to analyze the correlation between different types of chronic hepatitis and the risk of cardiovascular disease.

Ethics statements

The National Health Insurance Research Database (NHIRD) is derived from Taiwan’s mandatory National Health Insurance program was established by the National Health Insurance Administration Ministry of Health and Welfare and maintained by the National Health Research Institute (NHRI). The patient identifications in the National Health Insurance Research Database have been scrambled and de-identified by the Taiwan government, and the database is commonly used for different types of research such as in medical, and public health fields. Thus, informed consent was waived by the Research Ethics Committee of the China Medical University, and the study protocol was approved by the research ethics committee of China Medical University and Hospital (IRB number: CMUH106-REC3-153) and was conducted in accordance with the principles of the Declaration of Helsinki.

Data sources

This retrospective cohort study analyzed data from the National Health Insurance Research Database of the “Applied Health Research Data Integration Service from National Health Insurance Administration”. The data included outpatient prescriptions and treatments, outpatient prescriptions and medical orders, inpatient medical expense lists, inpatient medical expense and medical order lists, insurance details of persons, major injury and illness, medical institution master files, diagnosis, and P4P education records.

Definitions of variables

Hepatitis B: Those with ICD-9 070.2, 070.20, 070.21, 070.22, 070.23, 070.3070.31, 070.32, or 070.33 or ICD-10 B16, B17.0, B18.0, B18.1, or B19.1 as the primary and secondary diagnosis during two outpatient visits or one hospitalization within 365 days of study enrollment.

Hepatitis C: Those with ICD-9 070.41, 070.44, 070.51, or V02.62 or ICD-10 B17.10, B17.11, B18.2, B19.20, B19.21, or Z22.52 as the primary and secondary diagnosis during two outpatient visits or one hospitalization within 365 days of study enrollment.

NAFLD: Those with ICD-9 571.8, 571.9, or ICD-10 K74.4, K74.5, K74.60, K74.69, K76.0, K76.9, etc. as the primary and secondary diagnosis during two outpatient visits or one hospitalization within 365 days of study enrollment, and without the occurrence of a hepatitis B or C code, for whom the first hospital visit within 365 days was defined as the date of diagnosis. Patients with concurrent viral hepatitis and NAFLD were classified as having viral hepatitis.

Age-based categorization included 20–39, 40–54, 55–64, 65–74, and ≥ 75 years age groups. Monthly salary was divided into five grades, namely ≤ NTD 17,280, NTD 17,281–22,800, NTD 22,801–36,300, NTD 36,301–45,800, and ≥ NTD 45,801. Charlson comorbidity index was divided into 0, 1, 2, and ≥ 3 after excluding scores correlated with independent or dependent variables40.

The diabetes complications severity index (DCSI) was scored as 0, 1, and ≥ 2 points. The DCSI was calculated based on the classification and scoring method proposed by Young et al. If the patient had no complication, the score would be 0; for each complication, 1 point would be added; if the complication was serious, 2 points would be added. Based on this calculation method, the maximum score was 13 points41.

Cardiovascular disease: Those with ICD-9 398.91, 402.xx, 404.xx, 410.xx–414.xx, 422.xx, 425.xx or 428.xx, or ICD-10 I09.81, I11, I13, I20–I22, I24, I25, I40–I43, I50, R09.89, etc. as the primary and secondary diagnosis during two outpatient visits or one hospitalization within 365 days of study enrollment42.

Calculation of the coefficient of variation (CV% = standard deviation/mean) of HbA1c and fasting blood glucose: All measurements in the first year were used, and if the measurements were taken less than four times in the first year, measurements taken up to the second year were included. If measurements were taken less than four times in the 2 years, the patient would be excluded.

Adjusted CV = CV/√ (n/n − 1): When the examination data were limited, the examination times would affect the result of the CV. In this case, a relatively correct result of the CV with a reduced effect of the examination times could be obtained by correcting the examination times.

Analytical methods

Descriptive and inferential statistics were carried out according to the research objectives and framework. All research tests were based on a significance level of α = 0.05, and all statistical analyses were conducted using SAS software for Windows, version 9.4 (SAS Institute Inc., Cary, NC, USA). Descriptive statistics such as frequency, percentage, average, and standard deviation were used to describe the dependent and independent variables to be investigated in this study. This study adopted descriptive statistics to present the demographic characteristics, status of comorbidities, blood biochemical indicators, health status, economic factors, and medical care provider characteristics of patients with diabetes. The incidence of cardiovascular disease in patients with T2DM with chronic hepatitis per 1000 person-years was tested using univariate Poisson regression. The relative risks of cardiovascular disease in the four groups were calculated using a Cox proportional hazards model.

Reports & Events Monthly Calendar – July 2022 – The National Academies of Sciences, Engineering, and Medicine

Reports & Events Monthly Calendar – July 2022 The National Academies of Sciences, Engineering, and Medicine

Events, decisions, and reports at City Council for the week of June 20, 2022

Vancouver City Council met this week with some members joining electronically and others in person, to hear and discuss a variety of topics during Council, and Standing Committee on Policy and Strategic Priorities.

Tuesday, June 21

This week’s Council began with Mayor Kennedy Stewart giving remarks on and reading the National Indigenous Peoples Day proclamation. This was followed by the approval of the following reports and referral reports on consent:

After that, the Council approved the following reports:

Council approved By-laws 1 to 46 PDF file (16 MB), then the following Administrative Motions and Council Members’ Motions:

Council Members’ Motion Street Care, Not Street Sweeps: Ending Daily Displacement in Vancouver PDF file (26 KB) was referred to staff for consideration and response in the planned upcoming report to Council.

The following motions were referred to the Standing Committee on Policy and Strategic Priorities on Wednesday, June 22, 2022:

Council also approved two new business items:

- Requests for Leaves of Absence

- Provincial Apology for Sixties Scoop

On Tuesday evening, a Public Hearing was held where Council approved:

Heritage Designation – 347 West Pender Street, Hartney Chambers was withdrawn on June 14, 2022.

Wednesday, June 22

The Standing Committee on Policy and Strategic Priorities began with the approval of Contract Award for the Provision of Mobility Services and Devices for the City of Vancouver PDF file (51 KB) on consent.

The Standing Committee then approved the following reports and referred motions:

A Council meeting was convened immediately following the Standing Committee meeting, approving the recommendations and actions of the preceding Standing Committee on Policy and Strategic Priorities.

Thursday, June 23

A Public Hearing will convene on Thursday, June 23 at 6 pm, for Council to consider the following agenda items:

The next regular Council meeting is scheduled for Tuesday, July 5 at 9:30am.

More government co-ordination, communication needed to respond to extreme heat events: reports, experts – The Hill Times

Reports & Events Monthly Calendar – June 2022 | National Academies

Impact of COVID-19 on Birth Rates

June 1

Birth rates in the United States have been gradually declining for over a decade. While the COVID-19 pandemic led to a significant, though brief, drop in birth rates, they are now back to pre-pandemic levels. This webinar will cover why declining birth rates matter for policy decision-making at state and local levels.

Frontiers of Extreme Event Attribution

June 1

In this session, speakers will consider the scientific advances that have been made since the 2016 National Academies report Attribution of Extreme Weather Events in the Context of Climate Change, emerging approaches and methodologies, and use of extreme weather attribution to support decision-making.

Reimagining Science Communication in the COVID Era and Beyond

June 1, 2, and 6

This hybrid colloquium will explore how to build a more effective and equitable science communication ecosystem, advance the use of evidence-based practices, and determine next steps for the science of science communication and engagement.

Accelerating Decarbonization in the United States

June 6 and 13

These webinars features a wide range of speakers discussing public opinion on net-zero infrastructure, a just and equitable energy transition, and other related topics.

Enhancing Public Health Equity through Transportation

June 8

This webinar will provide insights from state, metropolitan, and municipal transportation agencies on how they use health equity to frame planning strategies and to evaluate and prioritize projects.

Using Findings from Patient-Centered Outcomes Research in Clinical Practice

June 9 and 17

The first and second workshop in a series, these events will explore potential ways to accelerate the use of patient-centered outcomes research (PCOR) findings in clinical practice to improve health and health care. Registration is available for in-person or virtual attendance.

Suicide Prevention in Indigenous Communities

June 10

This final webinar in a three-part series will discuss the current challenges, gaps, and opportunities for action to decrease suicide rates in Indigenous communities.

Leveraging Commercial Space for Earth and Ocean Remote Sensing

June 13 and 14

Rapid advances in small satellite technology and associated launch and production capabilities have changed the space industry. Participants in this workshop will explore ways to operationalize the findings of a recent National Academies report on the “New Space ecosystem.”

Supporting Children with Disabilities: Lessons from the Pandemic

June 13-15

This workshop will examine promising approaches and strategies employed during the pandemic to address challenges faced by children with disabilities and their families. The agenda will include discussion of access to clinical service and treatment needs, home caregiving, and mental health treatment — and practices that might be sustained or implemented beyond the pandemic.

Inclusion of Pregnant and Lactating People in Clinical Trials

June 16 and 17

This workshop will provide an opportunity for stakeholders to examine the current state of evidence generation for drug products used by pregnant and lactating individuals and discuss barriers and opportunities for including these populations in clinical trials. Registration is available for in-person or virtual attendance.

Climate Conversations: Water Justice

June 23

Millions of people in the U.S. lack access to clean and safe drinking water, particularly in low-income rural areas and in communities of color. Our changing climate creates additional threats, such as droughts that diminish water sources, and floods that overwhelm water treatment facilities. This webinar will discuss how policies and infrastructure could help address current disparities in access to water and build resilience to the increasing impacts from climate change.

Development of a Framework for Evaluating Global Greenhouse Gas Emissions Information for Decision-Making

June 27-28

The workshop will discuss developing independent, transparent, and comparable greenhouse gas information; understanding and addressing biases in data, models, and analytic frameworks; and synthesis and integration of the best available information on greenhouse gas emissions.

Advancing Progress in Cancer Prevention and Risk Reduction

June 27 and 28

This workshop will examine the current state of knowledge regarding risk factors for cancer and strategies for interventions across multiple levels to reduce cancer risk. Registration is available for in-person or virtual attendance.

Reports Scheduled for Release in June

Release dates for the following consensus reports and proceedings from the National Academies depend on successful completion of the review process and publishing schedules. Reporters who would like to be notified when a report is due for release should contact the Office of News and Public Information (e-mail news@nas.edu) and ask to be placed on a contact list.

Developing a Long-Term Strategy for Low-Dose Radiation Research in the United States

This report will recommend a long-term strategic research agenda on the human health impacts of low dose radiation in the U.S. The report will address coordination between federal agencies, assess the current state of research, and identify radiation health and safety issues that can be informed by future research.

Global Roadmap for Health Longevity

This report charts key recommendations across sectors that promote and advance healthy longevity across the life course. The recommended policies, socio-economic infrastructure improvements, and innovations have the potential to set societies on the path to provide healthier, more fulfilling, and productive lives from birth to death.

ADDITIONAL RESOURCES FOR REPORTERS

Virtual Events Market Size to Hit USD 366450 million by 2028 | Market Share, Growth, Trends, Key Players, Market Segmentation, Challenges, Restraints, Revenue, Recent Developments, Stakeholders and Forecast Research | Market Reports World

global Virtual Events market size is projected to reach US$ 366450 million by 2028, from US$ 115610 million in 2021, at a CAGR of 17.3% during 2022-2028.

Pune, May 04, 2022 (GLOBE NEWSWIRE) — Global Virtual Events Market 2022 research report represents a detailed overview of the current market situation and forecast till 2028. The study is perhaps a perfect mixture of qualitative and quantitative information highlighting key market developments, challenges, and competition the industry face alongside gap analysis and new opportunities available and trend within the Virtual Events Market. Further, this report gives Virtual Events Market size, recent trends, growth, share, development status, market dynamics, cost structure, and competitive landscape. The research report also includes the present market and its growth potential in the given period of forecast. An exhaustive and professional study of the global Virtual Events market report has been completed by industry professionals and presented in the most particular manner to present only the details that matter the most. The report mainly focuses on the most dynamic information about the global market.

Get a Sample PDF of the report – https://www.marketreportsworld.com/enquiry/request-sample/20110550

Moreover, the research report gives detailed data about the major factors influencing the growth of the Virtual Events market at the national and local level forecast of the market size, in terms of value, market share by region, and segment, regional market positions, segment and country opportunities for growth, Key company profiles, SWOT, product portfolio and growth strategies.

About Virtual Events:

Virtual events are online exhibitions that include breakout sessions, video conferencing, web conferencing, collaboration tools, communication, and social networking. Virtual events can be enabled on smartphones, desktops, laptops, and tablets. They can be used to announce the launch of new products, provide additional information to people, and obtain new vendors. The exhibit below represents the differences between physical events and virtual events.

Get a Sample Copy of the Virtual Events Market Research Report 2022

This report gives a detailed description of all the factors influencing the growth of these market players as well as profiles of their companies, their product portfolios, marketing strategies, technology integrations, and more information about these market players. Some of the major players are as follows:

The Major Key Players Listed in the Virtual Events Market Report are:

Global Virtual Events Market: Drivers and Restrains

The research report has incorporated the analysis of different factors that augment the market’s growth. It constitutes trends, restraints, and drivers that transform the market in either a positive or negative manner. This section also provides the scope of different segments and applications that can potentially influence the market in the future. The detailed information is based on current trends and historic milestones. This section also provides an analysis of the volume of production in the global market and of each type.

A thorough evaluation of the restrains included in the report portrays the contrast to drivers and gives room for strategic planning. Factors that overshadow the market growth are pivotal as they can be understood to devise different bends for getting hold of the lucrative opportunities that are present in the ever-growing market. Additionally, insights into market expert’s opinions have been taken to understand the market better.

Inquire more and share questions if any before the purchase on this report at – https://www.marketreportsworld.com/enquiry/pre-order-enquiry/20110550

On the whole, the report proves to be an effective tool that players can use to gain a competitive edge over their competitors and ensure lasting success in the global Virtual Events market. All of the findings, data, and information provided in the report are validated and revalidated with the help of trustworthy sources. The analysts who have authored the report took a unique and industry-best research and analysis approach for an in-depth study of the global Virtual Events market.

Global Virtual Events Market Segmentation:

The research report includes specific segments by region (country), company, Type, and Application. This study provides information about the sales and revenue during the historic and forecasted period. Understanding the segments helps in identifying the importance of different factors that aid the market growth.

By Type:

-

Online Exhibitions

-

Web Conferencing

-

Others

By Application:

-

Education

-

Healthcare

-

Finance and Banking

-

Others

Geographic Segment Covered in the Report:

The Virtual Events report provides information about the market area, which is further subdivided into sub-regions and countries/regions. In addition to the market share in each country and sub-region, this chapter of this report also contains information on profit opportunities. This chapter of the report mentions the market share and growth rate of each region, country and sub-region during the estimated period.

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

The study Objectives of this report are:

-

To study and analyze the global Virtual Events market size (value and volume) by company, key regions/countries, products and application, history data and forecast.

-

To understand the structure of the Virtual Events market by identifying its various sub-segments.

-

To share detailed information about the key factors influencing the growth of the market (growth potential, opportunities, drivers, industry-specific challenges and risks).

-

Focuses on the key global Virtual Events manufacturers, to define, describe and analyze the sales volume, value, market share, market competition landscape, SWOT analysis and development plans in the next few years.

-

To analyze the Virtual Events with respect to individual growth trends, future prospects, and their contribution to the total market.

-

To project the value and volume of Virtual Events submarkets, with respect to key regions (along with their respective key countries).

-

To analyze competitive developments such as expansions, agreements, new product launches, and acquisitions in the market.

-

To strategically profile the key players and comprehensively analyze their growth strategies.

This Virtual Events Market Research/Analysis Report Contains Answers to the following Questions

-

What developments are going on in that technology? Which trends are causing these developments?

-

Who are the global key players in this Virtual Events market? What are their company profiles, their product information, and contact information?

-

What was the global market status of the Virtual Events market?

-

What is the current market status of the Virtual Events industry? What’s market competition in this industry, both company, and country-wise? What’s the market analysis of the Virtual Events market by taking applications and types in consideration?

-

What will be the estimation of cost and profit?

-

What is the economic impact on the Virtual Events industry? What are global macroeconomic environment analysis results? What are global macroeconomic environment development trends?

-

What are the market dynamics of the Virtual Events market? What are the challenges and opportunities?

Purchase this report (Price 4900 USD for a single-user license) – https://www.marketreportsworld.com/purchase/20110550

Detailed TOC of Global Virtual Events Market Report 2022

1 Report Business Overview

1.1 Study Scope

1.2 Market Analysis by Type

1.2.1 Global Virtual Events Market Size Growth Rate by Type, 2017 VS 2021 VS 2028

1.2.2 Online Exhibitions

1.2.3 Web Conferencing

1.2.4 Others

1.3 Market by Application

1.3.1 Global Virtual Events Market Size Growth Rate by Application, 2017 VS 2021 VS 2028

1.3.2 Education

1.3.3 Healthcare

1.3.4 Finance and Banking

1.3.5 Others

1.4 Study Objectives

1.5 Years Considered

2 Global Growth Trends

2.1 Global Virtual Events Market Perspective (2017-2028)

2.2 Virtual Events Growth Trends by Region

2.2.1 Virtual Events Market Size by Region: 2017 VS 2021 VS 2028

2.2.2 Virtual Events Historic Market Size by Region (2017-2022)

2.2.3 Virtual Events Forecasted Market Size by Region (2023-2028)

2.3 Virtual Events Market Dynamics

2.3.1 Virtual Events Industry Trends

2.3.2 Virtual Events Market Drivers

2.3.3 Virtual Events Market Challenges

2.3.4 Virtual Events Market Restraints

3 Competition Landscape by Key Players

4 Virtual Events Breakdown Data by Type

5 Virtual Events Breakdown Data by Application

6 North America

7 Europe

8 Asia-Pacific

9 Latin America

10 Middle East & Africa

11 Key Players Profiles

12 Analyst’s Viewpoints/Conclusions

13 Appendix

Continued….

Browse the complete table of contents at – https://www.marketreportsworld.com/TOC/20110550#TOC

About Us: –

Market Reports World is the Credible Source for Gaining the Market Reports that will provide you with the Lead Your Business Needs. The market is changing rapidly with the ongoing expansion of the industry. Advancement in technology has provided today’s businesses with multifaceted advantages resulting in daily economic shifts. Thus, it is very important for a company to comprehend the patterns of the market movements in order to strategize better. An efficient strategy offers the companies a head start in planning and an edge over the competitors.

CONTACT: Market Reports World Phone: US: +1 424 253 0946 / UK: +44 203 239 8187 Email: sales@marketreportsworld.com Web: https://www.marketreportsworld.com

ICC To Allow One Bid For TV, Digital Rights For ICC Events – Reports

The International Cricket Council is reportedly said to allow a single bid for media rights for the ICC events. Usually, the global body gives the deal for eight years but this time they will initiate a four-year deal.

The ICC is preparing to introduce the broadcast right for the next cycle of ICC events, every year one event – World Cup, T20 World Cup or Champions Trophy – is likely to take place.

ICC officials visited Mumbai to collect viewership data from top Indian broadcasters – Reports

According to a Cricbuzz report, Sunil Manoharan, vice-president, of broadcast rights of the ICC, and Anurag Dahia, the chief commercial officer at the Dubai office of the world body, visited Mumbai and gave a presentation to the potential bidders of their plan.

Both the ICC officials have obtained the viewership data of a few broadcast giants like Disney + Hotstar (current broadcaster for ICC events), Sony Sports Network, Network 18 (they recently launched their channel Sports 18) and Fan Code.

The current value of ICC rights is approximately USD 1.9 billion for the duration of eight years but given that there will be a global competition every year, the overall value of the package is expected to double.

“They seem to be more interested in four-year deals but the bidders will be given the choice to opt for eight years too. They have their processes on how to calculate the appreciation for eight years,” an industry executive said, as reported by Cricbuzz.

ICC to allow Indian broadcasters to claim the media rights under one bid

The ICC will allow Indian broadcasters to grab the media rights for Television (TV) and Digital under one bid unlike the Board of Cricket for Control in India (BCCI) planned to sell the IPL rights for the next cycle under separate bids for TV and online streaming.

The process of the issue of media rights including the announcement of the tender is expected to be completed by the end of July.

Also Read: IPL Media Rights For Next Cycle Likely To Take Place In June – Reports