This release should be read in conjunction with Great-West Lifeco’s Quarterly Report to Shareholders for the period ended June 30, 2022, available on greatwestlifeco.com. The Quarterly Report to Shareholders includes the Company’s interim Management’s Discussion & Analysis (MD&A) and condensed consolidated interim unaudited Financial Statements for the period, prepared in accordance with International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board unless otherwise noted. Additional information relating to Great-West Lifeco is available on sedar.comOpens a new website in a new window. Readers are referred to the cautionary notes regarding Forward-Looking Information and Non-GAAP Financial Measures and Ratios at the end of this release. All figures are expressed in millions of Canadian dollars, unless otherwise noted.

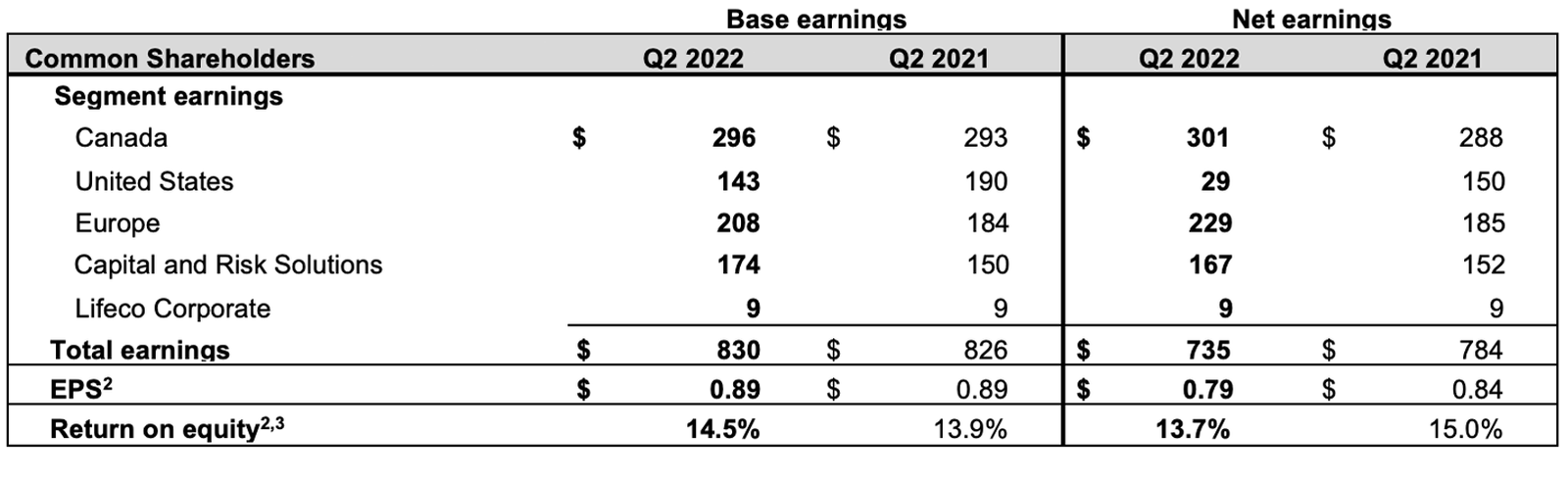

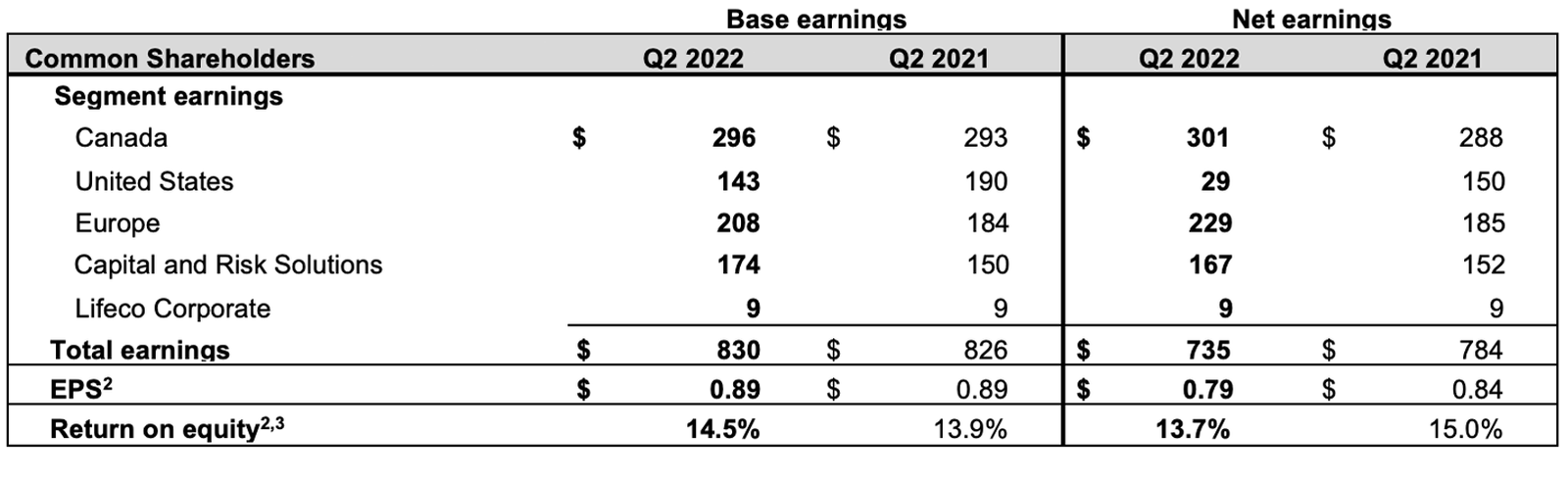

Winnipeg, August 3, 2022 – Great-West Lifeco Inc. (Lifeco or the Company) today announced its second quarter 2022 results. Net earnings of $735 million were down by 6% and base earnings1 of $830 million were slightly up compared to the same period in 2021.

“Against the backdrop of falling equity markets and elevated inflation, the Company’s well diversified and resilient business portfolio delivered solid results,” said Paul Mahon, President and CEO of Great-West Lifeco. “Strong insurance and investment results offset the dampening effect of equity markets on wealth and asset management businesses. We are pleased with the progress we are making on our strategic priorities including the recent close of Empower’s acquisition of the full-service retirement business of Prudential Financial Inc. The integration of this and our other acquired businesses in the U.S. are on track and we remain confident in the outlook for Empower and our value creation objectives for the business.”

Key Financial Highlights

In the second quarter of 2022, equity markets in the regions where the Company operates exhibited heightened volatility and ended 5% to 16% lower than March 31, 2022 levels. Interest rates increased 80-105bps in response to elevated, broad based levels of inflation which are impacting business and consumer confidence. In addition, the Canadian dollar strengthened notably against the British pound and the Euro, although weakened somewhat against the U.S. dollar.

Base earnings per share (EPS) for the second quarter of 2022 of $0.89 was consistent with $0.89 a year ago. This reflected strong insurance and investment results in all geographies which more than offset reduced net fee income from wealth management businesses and negative currency movement impacts. Base earnings grew year-over-year in the Canada, Europe and Capital and Risk Solutions segments. The U.S. segment base earnings were the most impacted by market conditions resulting in lower year-over-year base earnings notwithstanding the addition of Prudential business related base earnings of $45 million (US$35 million).

1 Base earnings is a non-GAAP financial measure. Refer to the “Non-GAAP Financial Measures and Ratios” section of this document for additional details.2 Base EPS and base return on equity are non-GAAP ratios. Refer to the “Non-GAAP Financial Measures and Ratios” section of this document for additional details.3 Base return on equity and return on equity are calculated using the trailing four quarters of applicable earnings and common shareholders’ equity.

Reported net EPS for the second quarter of 2022 was $0.79, down from $0.84 a year ago, primarily due to higher acquisition related costs largely from the Prudential acquisition. Also, the second quarter of 2021 included a revaluation of deferred taxes resulting in an increase in taxes in the Europe segment; there was no revaluation in 2022.

Return on equity of 13.7% and base return on equity of 14.5% in the second quarter of 2022 continued to be solid in light of the macroeconomic challenges and remain within our target range.

Business Highlights

Strategic acquisition of the full-service retirement business of Prudential Financial, Inc. closed

- On April 1, 2022, a Lifeco subsidiary, Great-West Life & Annuity Insurance Company (GWL&A), which operates primarily as “Empower”, closed the previously announced acquisition of the full-service retirement business of Prudential Financial, Inc. (Prudential). With the close of the acquisition, Empower’s reach in the U.S. has expanded to more than 17.4 million retirement plan participants and assets under administration (AUA) to US$1.3 trillion on behalf of approximately 71,000 workplace savings plans as of June 30, 2022.

The Company funded the total transaction value of US$3,480 million with US$1,193 million of limited recourse capital notes and US$823 million of short-term debt, in addition to existing resources.

The Prudential acquisition added $116 billion in total on balance sheet assets, $1 billion in other assets under management4 and $250 billion in other assets under administration4 to the U.S. segment as at June 30, 2022.

On August 1, 2022, Great-West Life & Annuity Insurance Company changed its legal name to Empower Annuity Insurance Company of America.

Capital strength and financial flexibility maintained

- The Company’s capital position remained strong at June 30, 2022, with a LICAT Ratio5 for Canada Life, Lifeco’s major Canadian operating subsidiary, of 117% which is near the high end of the Company’s internal target range and above the supervisory target. The LICAT Ratio reduced by two points in the quarter mainly due to the material in-quarter increase in interest rates.

- On July 21, 2022, OSFI released the 2023 LICAT Guideline. The Company will first report under this guideline in its March 31, 2023 LICAT filing. Based on an initial review of the guideline under the current market and economic conditions, the Company expects a positive impact to the March 31, 2023 LICAT Ratio6 on transition.

Consolidated assets of $670 billion and assets under administration7 of $2.3 trillion

- Consolidated assets were approximately $670 billion and AUA were approximately $2.3 trillion as at June 30, 2022, an increase of 6% and 2%, respectively, from December 31, 2021.

Other Developments

- On June 28, 2022, the Company hosted an analyst discussion on the expected impacts of the upcoming implementation of IFRS 178. The Company does not expect the new standard to have a material financial impact or to change the Company’s underlying business strategy9.

- The Company participated in the International Sustainability Standards Board (ISSB) consultation on two new draft standards which will help facilitate consistent, comparable and timely sustainability information for the good of the capital markets and, more importantly, our planet and our communities. The Company is a proud supporter of the ISSB as a member of the Coalition of Canadian Champions.

4 Refer to the “Glossary” section of the Company’s second quarter of 2022 interim MD&A for additional details on the composition of other assets under management and other assets under administration.

5 The Life Insurance Capital Adequacy Test (LICAT) Ratio is based on the consolidated results of The Canada Life Assurance Company (Canada Life), Lifeco’s major Canadian operating subsidiary. The LICAT Ratio is calculated in accordance with the Office of Superintendent of Financial Institutions (OSFI)’ guideline – Life Insurance Capital Adequacy Test. Refer to the “Capital Management and Adequacy” section of the Company’s second quarter of 2022 interim MD&A for additional details.

6 Actual impact will depend on market and economic conditions and the Company’s operating results at the time of transition.

7 Assets under administration is a non-GAAP financial measure. Refer to the “Non-GAAP Financial Measures and Ratios” section of this document for additional details.

8 IFRS 17, Insurance Contracts (IFRS 17) will replace IFRS 4, Insurance Contracts effective January 1, 2023. The new standard will change the recognition and measurement of insurance contracts and the corresponding presentation and disclosures in the Company’s financial statements.

9 Refer to the “Update on transition to IFRS 17 and IFRS 9” section of the Company’s second quarter of 2022 interim MD&A for additional details.

SEGMENTED OPERATING RESULTS

For reporting purposes, Lifeco’s consolidated operating results are grouped into five reportable segments – Canada, United States, Europe, Capital and Risk Solutions and Lifeco Corporate – reflecting the management and corporate structure of the Company. For more information, refer to the Company’s second quarter of 2022 interim MD&A.

CANADA

- Q2 Canada segment base earnings of $296 million and net earnings of $301 million – Base earnings for the second quarter of 2022 were $296 million, up 1% compared to the second quarter of 2021. The increase was primarily due to favourable morbidity and investment experience in Group Customer, partially offset by lower fee income and unfavourable experience in Individual Customer.

- Canada Life announced 2022 dividend scale for participating life insurance – On May 12, 2022, Canada Life announced the dividend scale interest rate will increase for the policies in the combined open participating account effective July 1, 2022 to 5.25%.

- Significant joint sale with ClaimSecure Inc. (ClaimSecure) – Canada Life Group Customer and ClaimSecure had their first significant joint sale in the second quarter of 2022. Integration is going well and quoting momentum is strong. Partnering with ClaimSecure has enhanced Canada Life’s ability to provide leading workplace benefits solutions to Canadians.

UNITED STATES

- Q2 United States (U.S.) Financial Services base earnings of US$123 million ($156 million) and net earnings of US$84 million ($107 million) – U.S. Financial Services base earnings for the second quarter of 2022 were US$123 million ($156 million), down US$16 million or 12% from the second quarter of 2021. The decrease was primarily due to lower Empower net fee income and higher operating expenses to support participant growth. These items were partially offset by base earnings of US$35 million ($45 million) related to the Prudential acquisition as well as higher contributions from investment experience.

Transaction costs of US$42 million ($53 million) related to the Prudential acquisition were included in the U.S. Corporate results.

- Run-rate cost synergies are on track – Annualized run rate cost synergies of US$88 million pre-tax have been achieved as of June 30, 2022 related to the Company’s acquisition of MassMutual’s retirement services business compared to US$80 million as of March 31, 2022. The Company remains on track to achieve run rate cost synergies of US$160 million pre-tax at the end of integration in 2022.

Empower anticipates realizing cost synergies through the migration of Prudential’s retirement services business onto Empower’s recordkeeping platform. Estimated run-rate cost synergies of US$180 million are expected to be phased in over 24 months primarily when systems migrations are completed. As of June 30, 2022, annualized run rate cost synergies of US$25 million pre-tax have been achieved.

- Empower growth in AUA and participant accounts – Empower AUA increased to US$1.3 trillion at June 30, 2022 from US$1.1 trillion at December 31, 2021. Empower participant accounts have grown to 17.4 million at June 30, 2022, up from 13.0 million at December 31, 2021. The increases in AUA and participants were primarily the result of the Prudential acquisition.

- Q2 Putnam net loss of US$9 million ($12 million) – Putnam’s net loss for the second quarter of 2022 was US$9 million ($12 million), compared to net earnings of US$17 million ($21 million) in the second quarter of 2021, primarily due to lower asset based fee revenue and lower net investment income, partially offset by lower expenses. For Putnam, there were no differences between net and base earnings (loss).

- Putnam continues to sustain strong investment performance – As of June 30, 2022, approximately 65% and 79% of Putnam’s fund assets performed at levels above the Lipper median on a three-year and five-year basis, respectively. In addition, 42% and 64% of Putnam’s fund assets were in the Lipper top quartile on a three-year and five-year basis, respectively. Putnam has 23 funds currently rated 4 or 5 stars by Morningstar Ratings.

- Putnam launched new sustainable investment options – During the second quarter of 2022, Putnam made a series of product-related announcements to meet evolving market demand for sustainable investment options, which are expected to launch over the coming months.

EUROPE

- Q2 Europe segment base earnings of $208 million and net earnings of $229 million – Base earnings for the second quarter of 2022 were $208 million, up 13% compared to the second quarter of 2021, primarily due to favourable investment experience in the U.K, favourable morbidity experience in Ireland as well as favourable mortality experience in the U.K. and Ireland, partially offset by the impact of currency movement. In addition, the Company had a revaluation of deferred taxes resulting in an increase in taxes in the second quarter of 2021; there was no revaluation in 2022. Net earnings for the second quarter of 2022 were $229 million, up $44 million or 24% from the second quarter of 2021, primarily due to an increase in base earnings as well as favourable market-related impacts driven by property cash flows in the U.K. in 2022 and unfavourable U.K. tax legislation changes in 2021. The increase was partially offset by lower actuarial assumption changes.

- Strong Insurance and Annuity sales10 – In the second quarter of 2022, Insurance and Annuity sales increased by 21% over the second quarter of 2021.

- Irish Life invested in a minority shareholding in Multiply.AI (Multiply) – In the second quarter of 2022, Irish Life invested in a minority shareholding in U.K.-based financial technology company Multiply. Multiply helps clients achieve their financial goals by connecting them through an automated digital advice service to their own individual financial plans with recommended next steps and access to their chosen advisor. This investment allows Irish Life to build on its existing digital capabilities by designing and building compliant digital customer journeys specific to the Irish market.

- Canada Life U.K. recognized as leading provider – The recent group protection industry survey ‘Group Watch 2022’ from Swiss Re confirmed Canada Life U.K. as the leading provider by in-force premium, policies and lives insured.

- Canada Life’s Credit Rating improved in Germany – In the second quarter of 2022, ASSEKURATA Assekuranz Rating-Agentur GmbH, a German financial strength rating agency, raised the credit rating of Canada Life Assurance Europe plc, a subsidiary of Canada Life, from AA- to AA, making Canada Life one of the highest rated life insurance companies in Germany.

10 Refer to the “Glossary” section of the Company’s second quarter of 2022 interim MD&A for additional details on the composition of sales.

CAPITAL AND RISK SOLUTIONS

- Q2 Capital and Risk Solutions segment base earnings of $174 million and net earnings of $167 million Base earnings for the second quarter of 2022 were $174 million, up 16% compared to the second quarter of 2021, primarily due to growth in business in-force, favourable claims experience in the U.S. life business and the commutation of a reinsurance treaty, partially offset by the impact of currency movement.

- Continue growing presence in the global reinsurance market – In the second quarter of 2022, Capital and Risk Solutions continued growing its international presence in Asia, Europe and the U.S. The Company entered into another reinsurance transaction in Israel, completed new longevity contracts in the U.K. and added new structured transactions in the U.S. during the quarter.

QUARTERLY DIVIDENDS

The Board of Directors approved a quarterly dividend of $0.4900 per share on the common shares of Lifeco payable September 29, 2022 to shareholders of record at the close of business September 1, 2022.

In addition, the Directors approved quarterly dividends on Lifeco’s first preferred shares payable September 29, 2022 to shareholders of record at the close of business September 1, 2022, as follows:

|

First Preferred Shares

|

Amount, per share

|

|

Series G

|

$0.3250

|

|

Series H

|

$0.30313

|

|

Series I

|

$0.28125

|

|

Series L

|

$0.353125

|

|

Series M

|

$0.3625

|

|

Series N

|

$0.109313

|

|

Series P

|

$0.3375

|

|

Series Q

|

$0.321875

|

|

Series R

|

$0.3000

|

|

Series S

|

$0.328125

|

|

Series T

|

$0.321875

|

|

Series Y

|

$0.28125

|

For purposes of the Income Tax Act (Canada), and any similar provincial legislation, the dividends referred to above are eligible dividends.

Second Quarter Conference Call

Lifeco’s second quarter conference call and audio webcast will be held August 4, 2022 at 2:30 p.m. (ET). The call and webcast can be accessed through greatwestlifeco.com/news-events/events or by phone at:

- Participants in the Toronto area: 416-915-3239

- Participants from North America: 1-800-319-4610

A replay of the call will be available until September 4, 2022 and can be accessed by calling 1-855-669- 9658 or 604-674-8052 (passcode: 9170). The archived webcast will be available on greatwestlifeco.com.

Selected financial information is attached.

GREAT-WEST LIFECO INC.

Great-West Lifeco is an international financial services holding company with interests in life insurance, health insurance, retirement and investment services, asset management and reinsurance businesses. We operate in Canada, the United States and Europe under the brands Canada Life, Empower, Putnam Investments, and Irish Life. At the end of 2021, our companies had approximately 28,000 employees, 215,000 advisor relationships, and thousands of distribution partners – all serving over 33 million customer relationships across these regions. Great-West Lifeco trades on the Toronto Stock Exchange (TSX) under the ticker symbol GWO and is a member of the Power Corporation group of companies. To learn more, visit greatwestlifeco.com.

Basis of presentation

The condensed consolidated interim unaudited financial statements of Lifeco have been prepared in accordance with International Financial Reporting Standards (IFRS) unless otherwise noted and are the basis for the figures presented in this release, unless otherwise noted.

Cautionary note regarding Forward-Looking Information

This release may contain forward-looking information. Forward-looking information includes statements that are predictive in nature, depend upon or refer to future events or conditions, or include words such as “will”, “may”, “expects”, “anticipates”, “intends”, “plans”, “believes”, “estimates”, “objective”, “target”, “potential” and other similar expressions or negative versions thereof. These statements include, without limitation, statements about the expected impact (or lack of impact) of IFRS 17, Insurance Contracts and IFRS 9, Financial Instruments on the Company’s business strategy, financial strength, deployable capital, Life Insurance Capital Adequacy Test (LICAT) ratio, base and net earnings, shareholders’ equity, ratings and leverage ratios. Forward-looking information also includes statements about the Company’s operations, business (including business mix), financial condition, expected financial performance (including revenues, earnings or growth rates), ongoing business strategies or prospects, climate-related goals, anticipated global economic conditions and possible future actions by the Company, including statements made with respect to the expected cost (including deferred consideration), benefits, timing of integration activities and timing and extent of revenue and expense synergies of acquisitions and divestitures, including but not limited to the acquisitions of the full-service retirement business of Prudential Financial Inc. (Prudential), Personal Capital Corporation (Personal Capital) and the retirement services business of Massachusetts Mutual Life Insurance Company (MassMutual), expected capital management activities and use of capital, estimates of risk sensitivities affecting capital adequacy ratios, expected dividend levels, expected cost reductions and savings, expected expenditures or investments (including but not limited to investment in technology infrastructure and digital capabilities and solutions), the timing and completion of the joint venture between Allied Irish Banks plc and Canada Life Irish Holding Company Limited, the impact of regulatory developments on the Company’s business strategy and growth objectives, the expected impact of the current pandemic health event resulting from the coronavirus (COVID-19) and related economic and market impacts on the Company’s business operations, financial results and financial condition.

Forward-looking statements are based on expectations, forecasts, estimates, predictions, projections and conclusions about future events that were current at the time of the statements and are inherently subject to, among other things, risks, uncertainties and assumptions about the Company, economic factors and the financial services industry generally, including the insurance, mutual fund and retirement solutions industries. They are not guarantees of future performance, and the reader is cautioned that actual events and results could differ materially from those expressed or implied by forward-looking statements. Many of these assumptions are based on factors and events that are not within the control of the Company and there is no assurance that they will prove to be correct. In particular, statements about the expected impact of IFRS 17 on the Company (including statements about the impact on base and net earnings and the Canada Life Assurance Company LICAT Ratio) are based on the Company’s expected 2022 IFRS 4 earnings mix and composition as at the start of 2022, adjusted to reflect fully synergized earnings from the acquisitions of MassMutual’s and Prudential’s retirement businesses, and on current market and economic conditions. In all cases, whether or not actual results differ from forward-looking information may depend on numerous factors, developments and assumptions, including, without limitation, the severity, magnitude and impact of the COVID-19 pandemic including the effects of the COVID-19 pandemic and the effects of governments’ and other businesses’ responses to the COVID-19 pandemic on the economy and the Company’s financial results, financial condition and operations), the duration of COVID-19 impacts and the availability and adoption of vaccines, the effectiveness of vaccines, the emergence of COVID-19 variants, geopolitical tensions and related economic impacts, assumptions around sales, fee rates, asset breakdowns, lapses, plan contributions, redemptions and market returns, the ability to integrate the acquisitions of Personal Capital and the retirement services business of MassMutual and Prudential, the ability to leverage Empower’s, Personal Capital’s and MassMutual’s and Prudential’s retirement services businesses and achieve anticipated synergies, customer behaviour (including customer response to new products), the Company’s reputation, market prices for products provided, sales levels, premium income, fee income, expense levels, mortality experience, morbidity experience, policy and plan lapse rates, participant net contribution, reinsurance arrangements, liquidity requirements, capital requirements, credit ratings, taxes, inflation, interest and foreign exchange rates, investment values, hedging activities, global equity and capital markets (including continued access to equity and debt markets), industry sector and individual debt issuers’ financial conditions (including developments and volatility arising from the COVID-19 pandemic, particularly in certain industries that may comprise part of the Company’s investment portfolio), business competition, impairments of goodwill and other intangible assets, the Company’s ability to execute strategic plans and changes to strategic plans, technological changes, breaches or failure of information systems and security (including cyber attacks), payments required under investment products, changes in local and international laws and regulations, changes in accounting policies and the effect of applying future accounting policy changes, changes in actuarial standards, unexpected judicial or regulatory proceedings, catastrophic events, continuity and availability of personnel and third party service providers, the Company’s ability to complete strategic transactions and integrate acquisitions, unplanned material changes to the Company’s facilities, customer and employee relations or credit arrangements, levels of administrative and operational efficiencies, changes in trade organizations, and other general economic, political and market factors in North America and internationally. In addition, as we work to advance our climate goals, external factors outside of Lifeco’s reasonable control may act as constraints on their achievement, including varying decarbonization efforts across economies, the need for thoughtful climate policies around the world, more and better data, reasonably supported methodologies, technological advancements, the evolution of consumer behavior, the challenges of balancing interim emissions goals with an orderly and just transition, and other significant considerations such as legal and regulatory obligations.

The reader is cautioned that the foregoing list of assumptions and factors is not exhaustive, and there may be other factors listed in other filings with securities regulators, including factors set out in the Company’s 2021 Annual MD&A under “Risk Management and Control Practices” and “Summary of Critical Accounting Estimates” and in the Company’s annual information form dated February 9, 2022 under “Risk Factors”, which, along with other filings, is available for review at www.sedar.comOpens a new website in a new window. The reader is also cautioned to consider these and other factors, uncertainties and potential events carefully and not to place undue reliance on forward-looking information.

Other than as specifically required by applicable law, the Company does not intend to update any forward-looking information whether as a result of new information, future events or otherwise.

Cautionary note regarding Non-GAAP Financial Measures and Ratios

This release contains some non-Generally Accepted Accounting Principles (GAAP) financial measures and non-GAAP ratios as defined in National Instrument 52-112 “Non-GAAP and Other Financial Measures Disclosure”. Terms by which non-GAAP financial measures are identified include, but are not limited to, “base earnings (loss)”, “base earnings (loss) (US$)” and “assets under administration”. Terms by which non-GAAP ratios are identified include, but are not limited to, “base earnings per common share (EPS)”, and “base return on equity (ROE)”. Non-GAAP financial measures and ratios are used to provide management and investors with additional measures of performance to help assess results where no comparable GAAP (IFRS) measure exists. However, non-GAAP financial measures and ratios do not have standard meanings prescribed by GAAP (IFRS) and are not directly comparable to similar measures used by other companies. Refer to the “Non-GAAP Financial Measures and Ratios” section in this release for the appropriate reconciliations of these non-GAAP financial measures to measures prescribed by GAAP as well as additional details on each measure and ratio.

For more information:

Media Relations

Liz Kulyk

204-391-8515

media.relations@canadalife.com

Investor Relations

Deirdre Neary

647-328-2134

deirdre.neary@canadalife.com