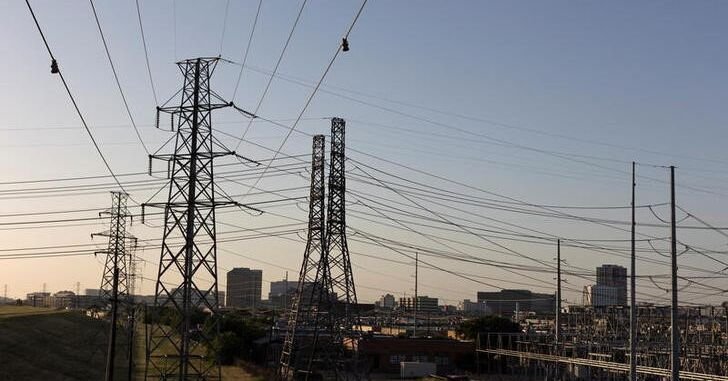

July 20 (Reuters) – The North American Electric Reliability Corp (NERC) on Wednesday said key entities of the U.S. power grid network were working to improve resilience of the power grid network as climate change drives more extreme weather.

The NERC’s “2022 State of Reliability” report said efforts were being made to improve the linkage between outages and weather by the Enterprise Electric Reliability Organization (ERO).

The ERO is made up of the NERC and six regional power entities.

Register now for FREE unlimited access to Reuters.com

The U.S. power grid network is also implementing corrective action to avoid a repeat of widespread outages due to a cold snap last year.

“The February cold weather event demonstrated that a significant portion of the generation fleet in the impacted areas was unable to supply electrical energy during extreme cold weather,” the NERC’s report said.

These actions, based on recommendations by the Federal Energy Regulatory Commission (FERC) and NERC among others, would also help to develop standards for longer term grid planning, the NERC said.

The report also highlighted the growing risks from the inter-dependency of electricity and the natural gas industries, which has threatened the reliability of the Bulk Electric System in the past few years. The Bulk Electric System refers to the facilities needed to operate the electric energy transmission network, excluding local distribution.

Natural gas generators are now needed for the reliable integration of renewable power until new storage technology is fully developed and implemented at scale, the NERC said.

“At the same time, reliable electric power supply is often required to ensure uninterrupted delivery of natural gas to these balancing resources, particularly in areas where penetration levels of renewable generation resources are highest.”

The NERC report also flagged risks from geopolitical events, while “increasingly bold cyber criminals and hacktivists presented serious challenges to the reliability” of the bulk electric system.

Register now for FREE unlimited access to Reuters.com

Reporting by Rahul Paswan in Bengaluru. Editing by Jane Merriman

Our Standards: The Thomson Reuters Trust Principles.