Each week, we search for the most exciting and thought-provoking shows, screenings, and events, both digitally and in-person in the New York area. See our picks from around the world below. (Times are all ET unless otherwise noted.)

Tuesday, August 16

Federico Zuccaro Taddeo Rebuffed by Francesco Il Sant’Angelo, (about 1595). Image courtesy the J. Paul Getty Museum.

1. “Hardship and Inspiration” at the Getty Center, Los Angeles

In this virtual talk on the occasion of “The Lost Murals of Renaissance Rome” (through September 4), Getty Museum curator Julian Brooks will explore one of the first illustrated “starving artist” narratives and its enduring relevance. Twenty drawings by Federico Zuccaro map out the setbacks, rejections, and eventual success of his older brother, Italian Renaissance painter Taddeo Zuccaro. Brooks will also explore how these images of artistic persistence have inspired 21st-century Los Angeles singer-songwriters.

Price: Free with Zoom registration

Time: 2 p.m. PT (5 p.m. ET)

—Eileen Kinsella

Friday, August 19

Blek Le Rat, Danseuse Colour (2021). Photo courtesy of West Chelsea Contemporary, New York.

2. “Blek Le Rat” at West Chelsea Contemporary, New York

French artist Blek Le Rat developed his unique blend of printmaking and graffiti in Paris the early 1980s after encountering street art in New York City and the work of Richard “Shadowman” Hambleton. His symbol was a small black rat: an anagram of the word “art” that he spread art throughout the city the way rats carry disease. Blek’s pop culture-infused stencil graffiti helped pioneer the art form and was highly influential: in Banksy’s first public interview, with the Daily Mail in 2008, the British artist lamented that “every time I think I’ve painted something slightly original, I find out that Blek Le Rat has done it too, only Blek did it 20 years earlier.”

Location: West Chelsea Contemporary, 231 10th Avenue, New York

Price: Free

Time: Monday–Wednesday and Saturday, 10 a.m.–6 p.m.; Thursday, 10 a.m.–8 p.m.; Sunday, 12 p.m.–6 p.m.

—Sarah Cascone

Saturday, August 20

Trisha Brown Dance Company in rehearsal at Rockaway Beach, Queens. Photo by Alice Plati for Beach Sessions Dance Series.

3. “Trisha Brown: Beach Sessions” at Rockaway Beach, New York

In this event, dancers will perform a work by choreographer Trisha Brown along the Rockaway shoreline. The audience is invited to follow the dancers along the beach as they move from Beach 97th Street to Beach 110th Street. Now in its eighth year, “Trisha Brown: In Plain Site” is a program highlighting a selection of early works by the choreographer specifically chosen to respond to the beach and its shoreline.

Location: Various locations, Rockaway Beach, New York

Price: Free

Time: 5:30 p.m.

—Neha Jambhekar

Through Friday, August 26

Nam June Paik, Admiral/Crying TV (2005). Photo by Rob McKeever, ©Nam June Paik Estate, courtesy of Gagosian.

4. “Nam June Paik, Art in Process: Part Two” at Gagosian, New York

Gagosian wraps up the second and final installment of its career survey of pioneering Korean American video artist Nam June Paik. The exhibition features three of the artist’s 1980s satellite broadcasts and late examples of his television sculptures. The show is curated by John G. Hanhardt, the man behind the artist’s shows at the Whitney Museum of American Art in 1982, the Guggenheim Museum in 2000, and the Smithsonian American Art Museum in 2011.

Location: Gagosian Park & 75, 821 Park Avenue, New York

Price: Free

Time: Monday–Friday, 10 a.m.–6 p.m.

—Sarah Cascone

Through Monday, September 5

Liz West, Hymn to the Big Wheel (2021) at Manhattan West. Photo by Jakob Dahlin, courtesy of Brookfield.

5. “Liz West: Hymn to the Big Wheel” at Manhattan West

Take advantage of the break in New York’s summer heatwave to check out this immersive sculptural work by Liz West just east of Hudson Yards. The octagonal structure features transparent sheets in jewel-like colors that catch the sunlight, creating vibrant shadows across cobblestone streets. The project is curated by Canadian public art firm Massivart, and was originally displayed last summer in London during the Canary Warf Summer Lights festival. It will also be on view on the Waterfront Plaza at Brookfield Place (September 9 through September 25).

Location: Manhattan West Plaza, 385 9th Avenue, New York

Price: Free

Time: 8 a.m.–7 p.m.

—Sarah Cascone

Through Sunday, September 18

“Adama Delphine Fawundu: Wata Bodis,” Newark. Photo by Anthony Alvarez, courtesy of Project for Empty Space, Newark.

6. “Adama Delphine Fawundu: Wata Bodis” at Project for Empty Space, Newark

Adama Delphine Fawundu, a 2022 artist-in-residence at Project for Empty Space, presents an exhibition featuring a 360-video projection and mixed-media hanging sculptures made from hand-dyed fabrics. Fawundu conceived of the exhibition, which is inspired by the African diaspora experience, as a spiritual conversation with her namesake, her late grandmother who she called Mama Adama. “Although our physical bodies have only shared space on this earth for 23 years, our spirits have always been intertwined,” Fawundu wrote in her artist’s statement.

Location: Project for Empty Space, 800 Broad Street, Newark

Price: TK Free

Time: Wednesday–Saturday, 11 a.m.–5 p.m.

—Sarah Cascone

Through Saturday, September 24

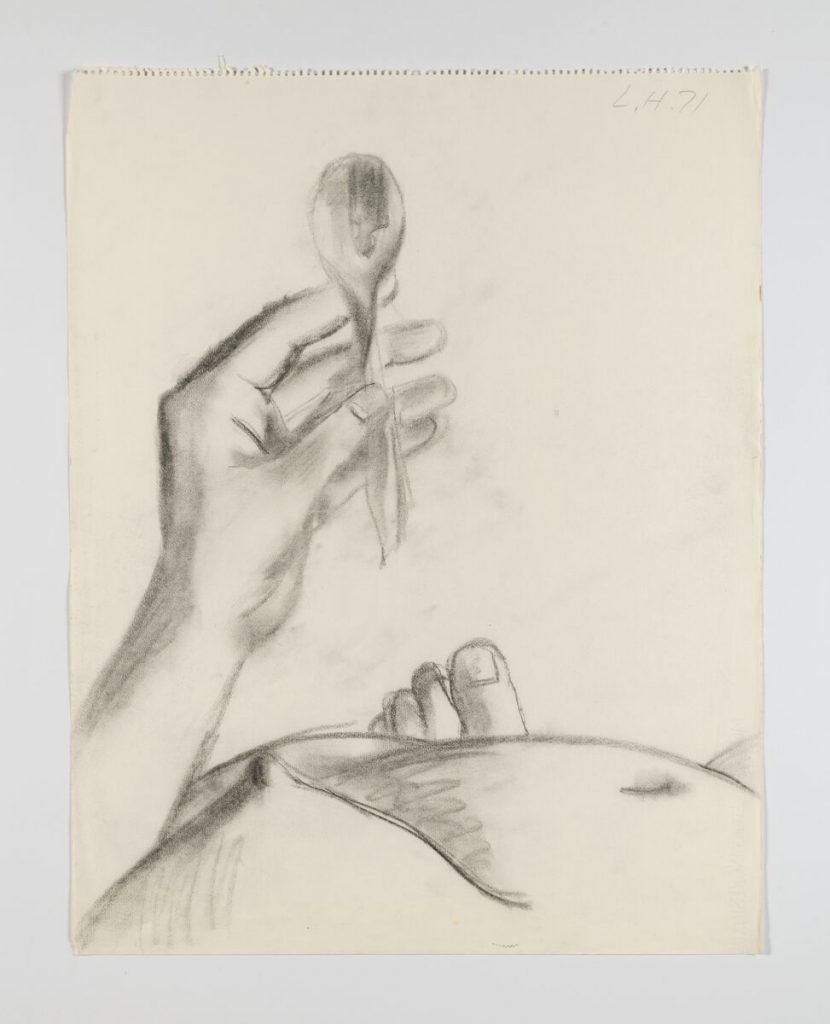

Luchita Hurtado, Untitled (1971). Photo by Jeff McLane, ©the Estate of Luchita Hurtado.

7. “Luchita Hurtado” at Hauser and Wirth, Southampton

Luchita Hurtado, who died in 2020 at age 99, only began to received recognition for her decades-long career in the final years of her life. But while you may have seen her paintings, Hurtado’s works on paper, including charcoal, crayon, graphite, and ink drawings, have kept a low profile. Hauser and Wirth presents intimate self-portraits, plus other pieces never exhibited in her lifetime.

Location: Hauser and Wirth, 9 Main Street, Southampton, New York

Price: Free

Time: Tuesday, Wednesday, Friday, and Saturday, 11 a.m.–6 p.m.; Thursday, 11 a.m.–8 p.m.; Sunday, 12 p.m.–6 p.m.

—Sarah Cascone

Tojiba CPU Corp, Disc Buddie #4448 (2022). Photo by Tom Powel Imaging, courtesy of Nahmad Contemporary, New York.

8. “The Painter’s New Tools” at Nahmad Contemporary, New York

There’s more to art and technology that the love-it-or-hate it NFT, as this group show at Nahmad Contemporary suggests. Artists pushing the boundaries of painting have been incorporating everything from computer printers and tablets to CGI, AI, and coding into their practices. The exhibition includes groundbreaking works by Darren Bader, Urs Fischer, Wade Guyton, Camille Henrot, and Sarah Sze, among others.

Location: Nahmad Contemporary, 980 Madison Avenue, Third Floor, New York

Price: Free with appointment

Time: Monday–Friday, 10 a.m.–6 p.m.

—Sarah Cascone

Follow Artnet News on Facebook:

Want to stay ahead of the art world? Subscribe to our newsletter to get the breaking news, eye-opening interviews, and incisive critical takes that drive the conversation forward.